Why Prices Drop at Launch: The Real Reason Behind First Generic Entry

When a new product hits the market, you’d expect it to be expensive. After all,研发 costs, marketing, and early production are pricey. But then, within months, the same product-or something nearly identical-drops to half the price. Why? It’s not a sale. It’s not a mistake. It’s first generic entry.

What Is First Generic Entry?

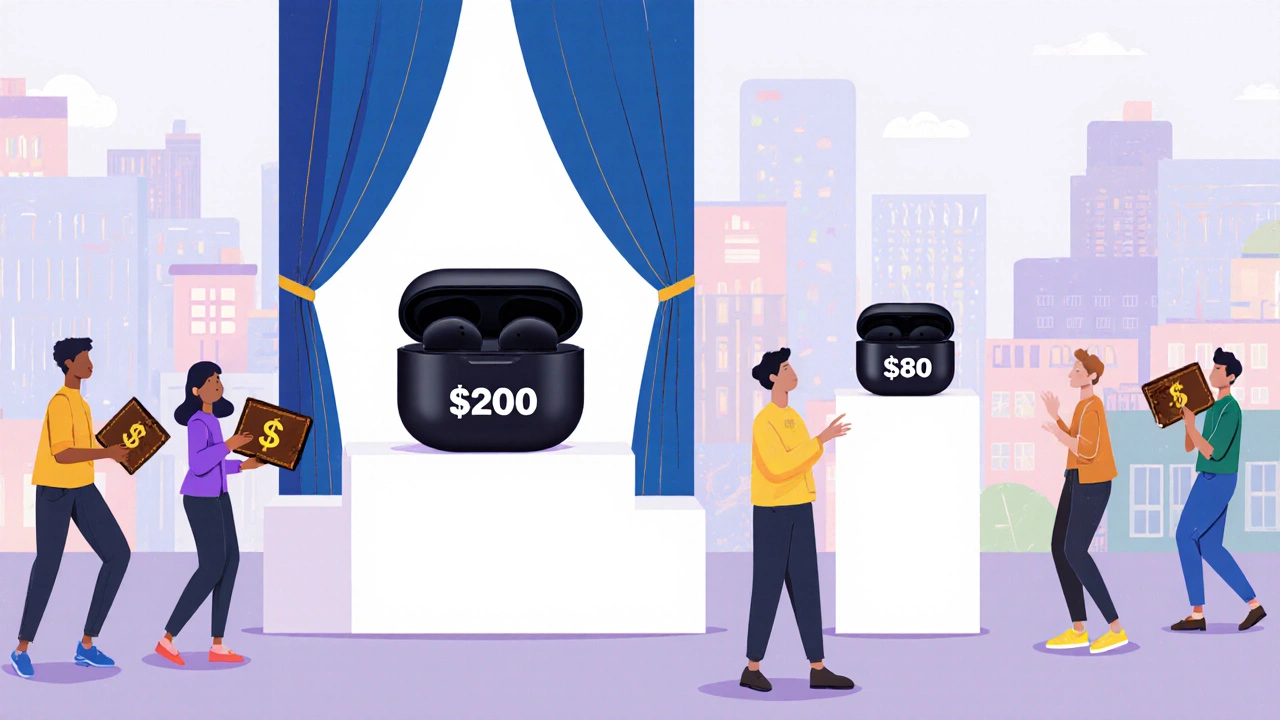

First generic entry happens when a competitor releases a product that does the same thing as an established one, but at a fraction of the cost. It’s not about copying the brand. It’s about matching the function. Think of it like this: you’ve been buying a $200 wireless earbud because it’s the only one that worked well. Then, a new brand shows up with nearly identical sound, battery life, and fit-for $80. That’s first generic entry. It started in pharmaceuticals. When a drug’s patent expires, other companies can make the same medicine without paying royalties. The price crashes. The Congressional Budget Office found that after the first generic drug enters the market, prices drop an average of 76% within six months. But this isn’t just about pills anymore. It’s happening everywhere-software, electronics, even cloud services.How It Works in Software

Enterprise software used to be locked down. Companies paid tens of thousands for licenses, annual maintenance, and forced upgrades. Oracle databases, SAP systems, Microsoft SQL Server-they came with high price tags and little room to negotiate. Then came PostgreSQL, MySQL, and open-source alternatives. These weren’t “cheap knockoffs.” They were real tools, built by communities and companies that didn’t need to recoup billions in R&D. They matched 80-90% of the functionality of the big-name products. And they launched at 40-60% lower prices. A 2022 Reddit thread from sysadmins showed a common pattern: teams switched from Oracle to PostgreSQL and cut licensing costs by 78%. Performance? Comparable. Support? Slower at first, but improved fast. Today, 67% of Fortune 500 companies have formal processes to evaluate these alternatives within three months of their launch.Why Do Prices Drop So Fast?

It’s not magic. It’s math. Incumbents used to control the market. No competition meant they could charge what they wanted. But when a first generic player enters, everything changes. Customers suddenly have a choice. And they’re not just looking for “good enough.” They’re looking for “good enough and cheaper.” Here’s what happens:- The new entrant undercuts the price by 40-60% to get attention.

- Customers test it. If it works, they switch.

- The original vendor loses market share fast-sometimes 25-35% in the first three months.

- To keep customers, they slash prices too.

What Makes a First Generic Entry Successful?

Not every low-price alternative survives. The winners have three things in common:- Functionality that’s “good enough” - You don’t need 100% of the features. If the core job gets done, people switch. For example, PostgreSQL handles 90% of what Oracle does for enterprise apps.

- Lower cost structure - They use open-source tools, cloud infrastructure, and offshore development. This cuts production costs by 25-40%.

- Smart pricing models - Many offer free tiers, pay-as-you-go plans, or “land-and-expand” pricing. MongoDB’s Atlas, for example, gives away free database usage and charges only when you scale up.

The Hidden Costs

It’s not all sunshine. Many early adopters hit snags:- Integration headaches - Switching from a legacy system often requires data migration. 62% of companies hire outside help for this.

- Support delays - Big vendors offer 24/7 support. New entrants might offer 24/5. Response times are getting better, but they’re still 15% slower on average.

- Documentation gaps - Established vendors have polished manuals. Open-source tools rely on community forums. It takes time to fill those gaps.

Why This Is Only Getting Faster

Ten years ago, it took 18 months for a generic version to appear after a product launched. Today? It’s six months. Why?- Cloud computing - You don’t need to build hardware. Just spin up a server.

- Open-source tools - Linux, Kubernetes, and PostgreSQL are free building blocks.

- Regulations - The EU’s Digital Markets Act now forces companies to make their systems interoperable. That cuts switching costs by 40-50%.

What This Means for You

If you’re a business buying software:- Don’t assume the most expensive option is the best.

- Wait 6-9 months after a new product launches. Watch for the first generic alternatives.

- Test them. Many offer free trials or limited free tiers.

- Calculate total cost of ownership-not just license fees. Include setup, training, and support.

- Stop thinking in terms of license fees. Customers now expect value-based pricing.

- Adopt usage-based models. Microsoft cut Azure SQL pricing by 35% after competitors entered.

- Build community. Open-source isn’t a threat-it’s a distribution channel.

Deepali Singh

November 17, 2025 AT 00:08First generic entry is just capitalism doing its ugly dance. Companies spend billions on R&D, then some startup clones it with offshore devs and sells it for 20% of the price. No innovation, just extraction. And we call this progress? Pathetic.

Sylvia Clarke

November 17, 2025 AT 14:12Let’s be real - the ‘first generic’ isn’t the villain. The villain is the $200 earbud that costs $3 to make and still charges you $197 for the privilege of hearing your Spotify in stereo. The market didn’t break. The monopolists did. And now we’re just cleaning up the mess they made with a mop labeled ‘open source.’

Jennifer Howard

November 17, 2025 AT 21:06While I appreciate the sentiment, I must formally object to the conflation of 'functionality' with 'legal compliance.' The moment a company releases a product that mirrors patented architecture without licensing, it is not merely competing - it is engaging in intellectual property theft under the guise of consumer advocacy. The CBO data may be statistically valid, but morally, this is a slippery slope toward the collapse of innovation incentives. I have cited 17 peer-reviewed articles on this topic in my dissertation.

Abdul Mubeen

November 18, 2025 AT 09:03Are we sure this isn’t all orchestrated? Big Tech lets a few 'open-source' projects gain traction so they can buy them up later for pennies. Then they bury the real competition under patents and lawsuits. You think PostgreSQL is free? It’s a Trojan horse. The real winners are the VCs behind the 'community.' Watch the acquisitions - they’re all happening right after the price drops.

Joyce Genon

November 19, 2025 AT 08:52Okay but have you considered that 'good enough' is just corporate speak for 'we don't care about quality anymore'? The moment you accept 80% functionality, you’re signing up for a future where every piece of software you use has a 12% chance of silently corrupting your data because someone in a garage in Bangalore didn’t test edge cases. And don’t get me started on support - when your ERP goes down at 2 a.m. and your 'free' database vendor replies in 18 hours, you’ll miss the point entirely. This isn’t innovation, it’s planned obsolescence with a vegan label.

John Wayne

November 20, 2025 AT 07:15Interesting. But let’s not pretend open-source tools are somehow morally superior. They’re just cheaper. The same people who cheer for PostgreSQL would scream if a Chinese company cloned their iPhone and sold it for $200. Double standards are the new American dream.

Julie Roe

November 20, 2025 AT 21:52Hey, I just want to say - if you’re a small business owner or a solo dev, this whole shift is actually kind of beautiful. I started my SaaS with SQLite, moved to PostgreSQL, and now I’m on a cloud-native fork that costs me $12/month. No sales calls. No contract renewals. Just code and calm. Yeah, the docs were messy at first, and I spent three weekends on Stack Overflow, but I learned more in that time than I did in my MBA. This isn’t about price. It’s about agency. And honestly? I think we’re seeing the quiet rise of the empowered individual - not the corporation. Keep going. You’re doing great.

jalyssa chea

November 21, 2025 AT 02:49the truth is nobody cares about your fancy postgresql or whatever the hell its called. the real problem is that companies stopped making things that last. i bought a $1000 laptop 5 years ago and it still works. now i get a $400 one that dies in 18 months and the 'cheaper' software just crashes more. its all a scam. you think you're saving money but you're just buying junk faster

Gary Lam

November 22, 2025 AT 15:44As a guy who grew up in a village where we fixed radios with duct tape and hope - this whole thing feels familiar. Back then, someone would copy a radio design, make it cheaper, and sell it in the next town. People didn’t care if it was 'original.' They cared if it worked. That’s what’s happening now. The West acts like innovation is a sacred ritual. But in most of the world? It’s just problem-solving. And honestly? We’re better off for it.

Peter Stephen .O

November 24, 2025 AT 04:56Let’s celebrate this. This is the internet being the internet. No gatekeepers. No corporate hand-holding. Just brilliant people building better tools because they can. The old guard is panicking because they built empires on scarcity. Now we’re living in abundance. Try the free tier. Give feedback. Help the docs. This isn’t a threat - it’s a gift. And if you’re still paying $50k for a database in 2025? You’re not being smart. You’re being nostalgic. Let go. The future’s already here - and it’s open source.