How Governments Keep Generic Drug Prices Low Without Direct Price Controls

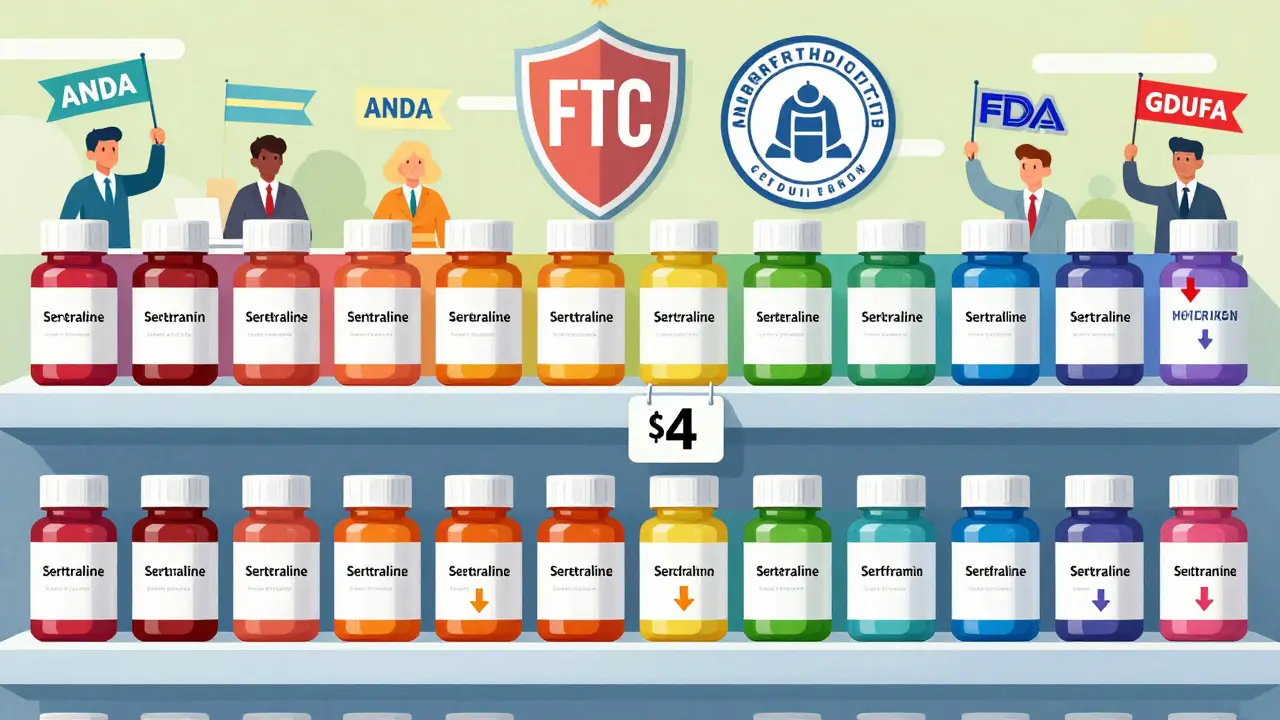

When you pick up a prescription for generic sertraline or metformin, you’re paying maybe $4 to $10 a month. That’s not luck. It’s the result of a carefully designed system built to let competition do the work-no government price-setting required. While headlines scream about $1,000 insulin costs, the truth is that generic drugs have been keeping millions of Americans on their meds for pennies, thanks to a mix of smart regulation, market forces, and enforcement against anti-competitive behavior.

Why Generic Drugs Don’t Need Price Caps

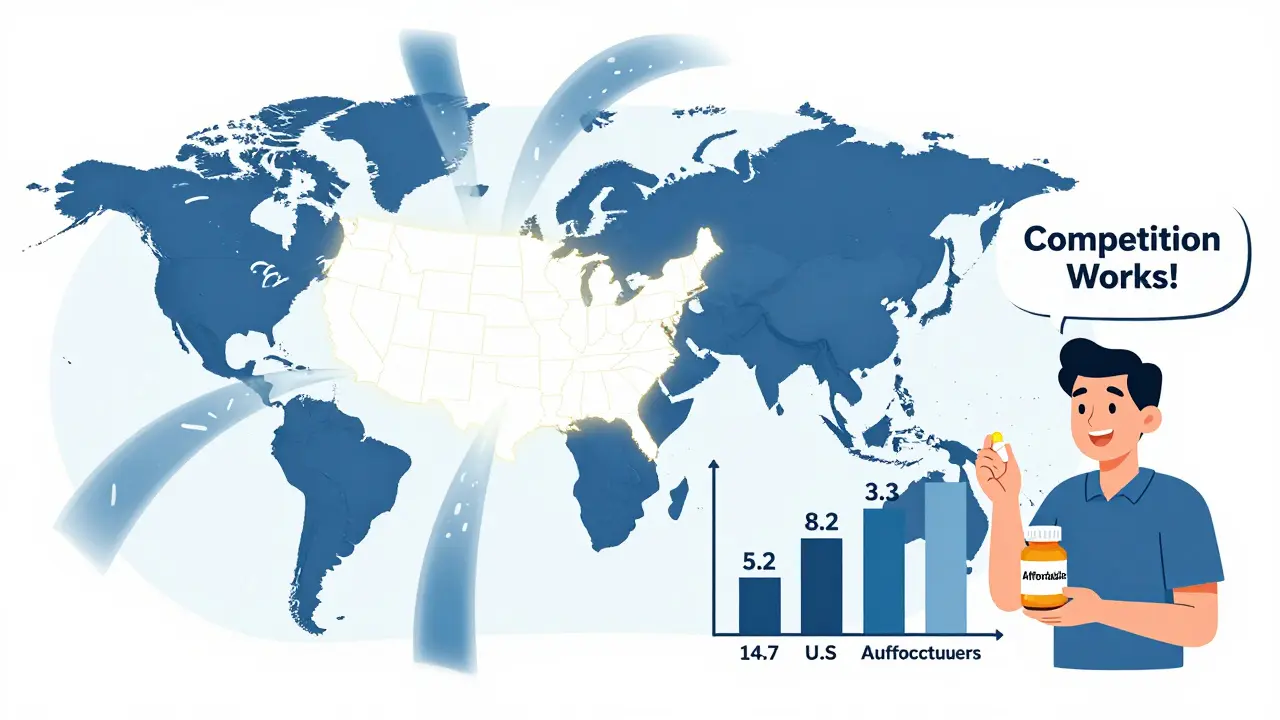

Most people assume that if a drug is cheap, the government must have capped the price. That’s not how it works with generics. In the U.S., generic drugs are priced by competition, not by decree. When a brand-name drug’s patent expires, multiple companies can make the same pill. The first one to enter might charge a bit more, but within weeks, others follow. By the time five or six manufacturers are selling the same drug, prices drop to 10-15% of the original brand price. The Federal Trade Commission (FTC) found that in markets with three or more generic makers, prices stabilize at that level-no regulation needed. The Congressional Budget Office (CBO) reports that generics make up 90% of prescriptions but only 23% of total drug spending. That’s because they’re cheap. A 2022 FDA analysis showed that after a generic hits the market, prices fall 75% within six months and 90% within two years if multiple companies are selling it. That’s not price control. That’s capitalism working the way it should.The Hatch-Waxman Act: The Secret Weapon

The system that makes this possible started in 1984 with the Hatch-Waxman Act. Before this law, generic companies had to run full clinical trials-just like the brand-name maker-to prove their drug was safe and effective. That cost $2 billion and took a decade. Hatch-Waxman changed that. It created the Abbreviated New Drug Application (ANDA) process, letting generic makers prove their drug is bioequivalent to the brand, not that it’s brand new. That cut development costs from billions to just $2-3 million. The result? A flood of generics. In 2023 alone, the FDA approved 1,083 generic drugs. That’s up 35% since 2017. The law didn’t set prices. It removed barriers so competition could. And it worked. The Food and Drug Administration (FDA) now requires generic manufacturers to show their pills dissolve at the same rate and deliver the same amount of active ingredient as the brand. That’s it. No extra trials. No extra cost. Just more options.How the FDA Speeds Up Generic Approvals

Approval delays used to be a major problem. It could take 18 months just to get a generic approved. That meant fewer competitors, slower price drops. The Generic Drug User Fee Amendments (GDUFA) fixed that. Passed in 2012 and renewed in 2022 with $750 million in industry fees through 2027, GDUFA gave the FDA the money and mandate to hire more reviewers and cut approval times. By 2023, the FDA hit its goal: 92% of priority generic applications got a decision within 10 months. That’s a massive improvement. But not all generics are easy. Complex drugs-like inhalers, injectables, or those with tricky formulations-still take longer. Only 38% of complex generics met the 10-month target in 2023. To fix this, the FDA created a special submission template in late 2023. Early results show a 35% drop in review time for those pilot applications. You can track every application in real time on the FDA’s Generic Drug User Fee Public Dashboard. If a company submits an ANDA, you can see where it is in the queue-whether it’s under review, waiting for more data, or approved. Transparency helps keep the system honest.

Why Medicare Doesn’t Negotiate Generic Drug Prices

The Inflation Reduction Act of 2022 let Medicare negotiate prices for some brand-name drugs. But generics? Excluded. Why? The Department of Health and Human Services (HHS) said it outright: generics already compete hard enough. In April 2024, CMS confirmed the program only targets drugs with no generic or biosimilar alternatives. A 2024 Stanford Medicine white paper estimated that extending negotiation to generics would save just $1.2 billion a year-less than 1% of total generic spending. Meanwhile, negotiating just 15 high-cost brand-name drugs like Ozempic and Wegovy could save $9.5 billion. That’s why policymakers focus there. The Congressional Budget Office also looked at international reference pricing for generics-where the U.S. would pay what other countries pay. Their estimate? A $2.1 billion annual cut in Medicare spending. Sounds good, right? But that’s just 0.4% of total generic spending. The cost of setting up and enforcing such a system? Far higher than the savings.What’s Really Driving Generic Price Spikes?

You’ve probably heard stories: someone’s generic blood pressure pill jumped from $5 to $50 overnight. That’s not the norm. In fact, the Government Accountability Office (GAO) found that between 2019 and 2022, 97% of generic price increases were below inflation. Only 3% spiked above it. Most of those spikes came from a handful of drugs with only one or two manufacturers. The real issue? Market concentration. When only one company makes a generic, it can raise prices. That’s why the FTC spends so much time blocking anti-competitive behavior. In 2023 alone, they challenged 37 "pay-for-delay" deals-where brand-name companies pay generic makers to delay entering the market. These deals cost consumers $3.5 billion a year. The FTC’s 2023 Pharmaceutical Competition Report says these practices are the main threat to generic pricing, not the lack of price controls. Another problem? Discontinued drugs. In 2024, the American Society of Health-System Pharmacists (ASHP) found that 18% of hospital pharmacists had trouble getting critical generics because manufacturers stopped making them. Why? The price was too low to cover production costs. That’s a supply issue, not a price control issue. When the profit margin disappears, companies leave. The FDA and FTC are now working to prevent "product hopping"-where brand companies tweak a drug slightly to block generics-and encourage authorized generics to stay in the market.

Jenna Allison

January 23, 2026 AT 17:22Did you know the FDA has a whole team just to fast-track generic approvals? They even have a dashboard where you can track every ANDA in real time. It’s wild how transparent the system is compared to other countries. I’ve literally watched a drug go from submitted to approved in 6 months - and prices dropped like a rock after that. No price caps needed, just competition.

Elizabeth Cannon

January 23, 2026 AT 17:54bro i just paid 3 bucks for my metformin at walmart and i thought it was a glitch. turns out its not magic its just american capitalism working. why the hell are we even talking about price controls when this shit already works? someone get this man a medal.

siva lingam

January 23, 2026 AT 21:57so the system works... until its not working. then its the fault of the market. classic. when the one company left raises the price from 5 to 50 its not monopoly its just capitalism being capitalism. i mean sure whatever.

Phil Maxwell

January 25, 2026 AT 18:24interesting. i never thought about how the FDA’s funding model actually drives faster approvals. it’s like they turned a bureaucratic problem into a performance metric. kinda elegant in a nerdy way. i’m not surprised it works better than we expect.

Shelby Marcel

January 26, 2026 AT 17:49wait so if only one company makes a drug and they jack up the price its not the govts fault? but if 14 companies make it its fine? that seems like a huge loophole. also why does the fda even allow that to happen in the first place?

blackbelt security

January 27, 2026 AT 15:48the real hero here is the Hatch-Waxman Act. no one talks about it but it’s the reason your insulin isn’t $2000. it’s like the secret sauce no one knows about. the system’s not perfect but it’s the best we’ve got. don’t break it.

Patrick Gornik

January 27, 2026 AT 19:32ah yes, the myth of the free market’s divine intervention - where invisible hands magically lower prices while regulatory agencies play the role of celestial bouncers, ejecting pay-for-delay trolls from the club of capitalism. how poetic. but let’s not pretend this isn’t a rigged game where the same 5 corporations own the FDA’s approval queue and the FTC’s budget. competition? more like oligopoly with a side of PR.

They tout 14 manufacturers per drug - but how many are subsidiaries of the same Big Pharma parent? How many are ‘authorized generics’ - a clever shell game where the brand company lets its own subsidiary sell the same pill for pennies to pretend there’s competition? It’s capitalism with a velvet glove - still a fist underneath.

And don’t get me started on the ‘transparency’ dashboard. It’s like giving a prisoner a live feed of the prison yard while the guards control the camera angles. Sure, you can see the queue - but who’s pulling the strings behind the submission? The FDA’s own data shows 60% of complex generics come from just three companies. That’s not competition. That’s cartel economics with a compliance badge.

And yet we’re told to trust the system because ‘it works’? It works for the 97% of generics that don’t spike - but for the 3% that do? Those are the ones that kill people. A single pill jump from $5 to $50 isn’t a market glitch - it’s a moral failure dressed in economic jargon. We don’t need more competition. We need accountability. We need to ask: who benefits when a drug becomes unaffordable? And why do we keep pretending the market isn’t the problem?

The CBO’s projections? Cute. But projections don’t feed diabetics. Transparency doesn’t stop a manufacturer from quietly shutting down a plant because the profit margin’s too thin. And no, ‘more competitors’ won’t fix a system where the barriers to entry are engineered by the very companies that profit from scarcity.

Let’s stop pretending capitalism is a force of nature. It’s a design. And right now, it’s designed to protect profits - not patients.

Tommy Sandri

January 29, 2026 AT 15:19It is noteworthy that the United States maintains a robust regulatory infrastructure that enables generic drug access without direct price intervention. The convergence of legislative frameworks, such as Hatch-Waxman, and fiscal mechanisms like GDUFA, reflects a mature policy ecosystem. This model stands in contrast to many international systems reliant on centralized price negotiation.

Tiffany Wagner

January 30, 2026 AT 08:11i just realized how much i take this for granted. i’ve been on the same generic for years and never thought about why it’s so cheap. thanks for explaining it. makes me feel a little less angry about the system.

Chloe Hadland

January 31, 2026 AT 06:43so many people complain about drug prices but never realize how much of it is already solved. generics are the quiet heroes of healthcare. i’m so glad we have this system. it gives me hope.

Amelia Williams

February 1, 2026 AT 01:14omg this is the most hopeful thing i’ve read about healthcare in years. we don’t need to tear it all down - we just need to protect what’s working. more transparency, faster approvals, and crush pay-for-delay deals. that’s the win. let’s not fix what ain’t broke.

Viola Li

February 2, 2026 AT 03:40oh please. the FTC ‘challenged’ 37 pay-for-delay deals? that’s like arresting 37 thieves while the bank is on fire. you think they’re actually stopping the real players? the same pharma giants that own the FDA’s advisory panels? this is theater. they let the small fish go so you think the system’s clean.

Dolores Rider

February 3, 2026 AT 04:19they’re lying. the fda and big pharma are in bed together. you think the 10-month approval window is real? it’s a lie. they hold back generics until the brand’s patent expires by 1 day. then they ‘approve’ them all at once. it’s a scam. i know someone who works there. they told me. 😡

venkatesh karumanchi

February 4, 2026 AT 01:46in india we have generics too - but they’re cheaper because we don’t have patents. here you have laws to make it fair. i think this is beautiful. america found a way to make capitalism work for the poor. 🙏

Himanshu Singh

February 5, 2026 AT 08:20the real genius isn’t the law - it’s the fact that nobody in pharma wanted to fight this. they knew competition would crush them. so they adapted. smart move. now they make billions on the brand versions while letting the generics do the heavy lifting. it’s not perfect, but it’s the most elegant solution i’ve seen.